Q: if you cancel/close a credit card account within a short time (lets say 6 months) you took it, will it affect your credit score?

A: It will probably not. This kind of behavior should fall into the “New Credit” section that is in your credit report, however, since the majority of this section is to figure out your interest to new credit, the more you are interested, the more negative to your credit. Given this guideline, if you close new accounts shortly, that doesn’t affect your credit score negatively.

References: How Your FICO Credit Score is calculated from myFICO.com. You may also find out your FICO score by visiting here.

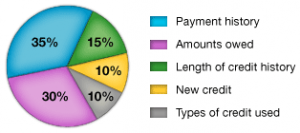

FICO Scores are calculated from a lot of different credit data in your credit report. This data can be grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining your FICO score.

These percentages are based on the importance of the five categories for the general population. For particular groups – for example, people who have not been using credit long – the importance of these categories may be somewhat different.

Payment History

- Account payment information on specific types of accounts (credit cards, retail accounts, installment loans, finance company accounts, mortgage, etc.)

- Presence of adverse public records (bankruptcy, judgements, suits, liens, wage attachments, etc.), collection items, and/or delinquency (past due items)

- Severity of delinquency (how long past due)

- Amount past due on delinquent accounts or collection items

- Time since (recency of) past due items (delinquency), adverse public records (if any), or collection items (if any)

- Number of past due items on file

- Number of accounts paid as agreed

Amounts Owed

- Amount owing on accounts

- Amount owing on specific types of accounts

- Lack of a specific type of balance, in some cases

- Number of accounts with balances

- Proportion of credit lines used (proportion of balances to total credit limits on certain types of revolving accounts)

- Proportion of installment loan amounts still owing (proportion of balance to original loan amount on certain types of installment loans)

Length of Credit History

- Time since accounts opened

- Time since accounts opened, by specific type of account

- Time since account activity

New Credit

- Number of recently opened accounts, and proportion of accounts that are recently opened, by type of account

- Number of recent credit inquiries

- Time since recent account opening(s), by type of account

- Time since credit inquiry(s)

- Re-establishment of positive credit history following past payment problems

Types of Credit Used

- Number of (presence, prevalence, and recent information on) various types of accounts (credit cards, retail accounts, installment loans, mortgage, consumer finance accounts, etc.)

Also check out service review of credit reporting/monitoring and identity theft services

If I negotiate a lower interest rate with a credit card co. will this affect my credit rating?

Frances, being able to negotiate down interest rate with credit card company proves the soundness of your credit profile. This action itself won’t affect your credit score, however, if the credit card company requested inquiry to credit bureau before they lowered your rate, it may affect your score. Even that happens, it will usually lower your score slightly and temporarily, the biggest factor, as indicated in the post, is still on time bill payment.